Money

Well, at Least Finance and Chocolate

It's customary among financial columnists and bloggers, at least the honest ones, to occasionally revisit their suggestions, predictions, and WAGs. Almost inevitably some of the portents have been misread and their past writings have proven to be risibly ridiculous, or at least just plain wrong. But not mine! I'm both honest and unbowed, and in a revisiting mood. Herewith a summary of this blog's financial suggestions of the past and how they fared in the intervening years. As an extra added plus, some suggestions for the balance of your lifetime from me and from my buddy Scott Adams, the Dilbert cartoonist.*

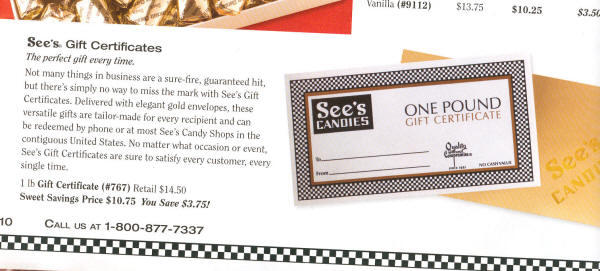

Hedging Dollar Inflation With the Pound

Click on the heading above to read my original blogitem about investing in The Chocolate. At the time I recommended it, I mentioned that it was almost guaranteed to appreciate, and to do so tax-free. Was I right? Yes! The certificates I "spent" brought me chocolatic joy, and those I retained, as you can see below, have already enjoyed an almost 37% appreciation. If you read the original article, note that I subsequently discovered what would be considered a sales "load," as described in this letter to Warren Buffett. To be consistent in the calculation of the certificate's value, increase the cost by your local sales tax if See's has a presence in your state.

|

||||||||||

|

Above, 2007 Sees Gift Certificate, 2012 Below

|

||||||||||

|

|

What About the Socks and the Swim Suits?

A hit and a semi-miss, not in that order. The swim suits continue to perform their duty, both in my closet and in the pool. When worn, they prevent me from being arrested. When reposing in their niche, they slowly, imperceptibly, day-by-day, increase in monetary value in concert with their on-offer conspecifics in stores. A good investment, although harder to quantify monetarily.

Not quite so the socks. Due to the official Rules, Leg Covering, bottom portion thereof, it has been decided on my behalf that the socks that I expected to suffice for the balance of my natural life are not appropriate for wearing under many circumstances. I am therefore blessed and/or cursed with such a surfeit of socks that they will last beyond my actuarial tenure. I shall plan to consider them as part of my legacy, or perhaps just my footacy, given their failure to comport with the Rules mentioned above.

And The Shrimp Boat?

A wise decision on my part and, I suspect, on yours.

And the Radioactive Dollars in Kazakhstan?

It's still a mystery!

What Does Richard Have to Say?

If you aren't really rich, you can save a significant portion of your wealth by shopping at Costco or BJ's or stores of their ilk. Peanut butter goes bad very slowly, paper towels, toilet paper, and other staples not at all. It's all much cheaper in bulk. (But do watch out for Kellogg's Frosted Mini Wheats, which don't last as long as they should, and also for yogurt, which, if kept too long, will go good.)

If you are really rich, do it anyway. It's good practice and it provides a bit of discipline to the market.

Pay your taxes on time. Or at least check the real deadline more carefully.

If you want to give money to charity, you could consider and then reject the advice that I don't have.

Be careful with possible Ponzi Schemes and be skeptical of new aircraft programs.

Pay attention. Even if you pay your utility, cable, and other routine bills automatically, check them every half year or so and call the company to complain about the prices. They will find a different "plan" or "bundle" or promotion of some sort that will significantly reduce your bill for a while until it starts to creep up again.

What Does Russell Stover Have to Say?

Without interviewing Russell, I deduce he's implying by this that sometimes there is a Free Lunch. And, indeed, sometimes there is. But don't count on it.

What Does Scott Adams Have to Say?

Pretty much what everyone not trying to sell you something has to say.

|

Everything you need to know about financial planning*

If any of this confuses you, or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio. *From Dilbert and the Way of the Weasel, 2002 |