RIKLBLOG

|

| Tomorrow |

| 21 Sept. 2007 |

| Yesterday |

| Index |

| Eventide |

| SETI League |

| PriUPS Project |

| Bonus! |

| Contact |

Hedging Dollar Inflation With the Pound

As you know, I rarely give financial advice, although on those occasions on which I have it's turned out to be good advice indeed. Finance is the stock-in-trade (along with politics) of my favorite blogger, Andy Tobias, and he has a stable of gurus to help him. I'm all alone here, but every once in a while I encounter a deal that meets my standards for "too good to be true" yet nonetheless seems to be valid.

Behold the dream financial instrument!

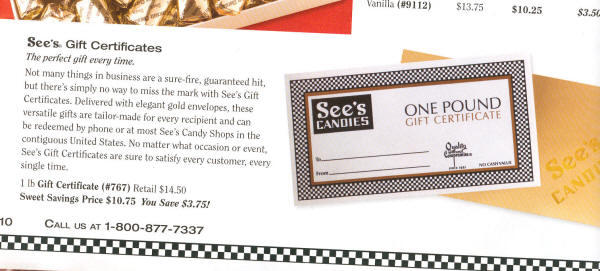

I was originally intrigued by this investment when I received a catalog from See's Candies. It was the usual pre-holiday-season gift catalog touting confections for colleagues and customers. Spend enough money and get a discount. Although I don't partake in that annual frenzy, I do look at the chocolates in the catalog. See's is a bit of problem for me as I enjoy their product only selectively. I can't buy a "box"—I have to pick its contents personally. I discovered See's existence in the late sixties when I first visited California. They have a number of retail outlets there and elsewhere in the West, but none east of Illinois. Their chocolate is good and inexpensive, but not worth an airline trip to obtain. Therefore I limit myself to the occasional mail order, which would account for my being on their list. Normally I view the newly-arrived catalog as an opportunity to consider whether it's time to place an order. I concluded "Not yet; it's still too warm out" and was about to toss the catalog when this gift certificate caught my eye.

"What's all this then?" I mentally declaimed in my best Pythonic fashion. It looked as if I could get a gift certificate for myself, and then use it to buy chocolate at a discount. Since certain parts of the offer weren't clear to me, I called their toll-free number and spoke with Karen B..., an informed and enthusiastic salestron. During our conversation, I found that the certificates never expire and are redeemable not for a cash value but rather, as it says on the certificate, one pound of chocolate. Subvocalizing a "Hmmmm" at this point, I suddenly realized what we had here: individual chocolate futures! But unlike ordinary futures contracts, these are good forever and one can more easily take delivery. Furthermore, in the long run, they are almost guaranteed to appreciate and therefore have little risk. The table below compares them to gift certificates at normal stores.

| Attribute | Standard Gift Certificate | See's Candies Gift Certificate |

| Ratio of value to cost | Pay a dollar, get a dollar | Pay a dollar, get $1.35 |

| Expires | Sooner or later (in many states) | Never |

| Service charge | Immediately to eventually | Never |

| Buys | Its dollar value in merchandise | A pound of chocolate, no matter how expensive it may become |

| Taxation | None - it never increases in value | None - value increase is tax-exempt! |

| Safety | Depends on seller | In business since 1921, longer than many countries |

| Cash Value | Maybe | None! No temptation to wimp out |

Because these are designed for See's commercial customers to give for the holiday season, they probably didn't think too hard about their long-term implications. That's why you keep me around:

- It's true that the minimum purchase is about $500. That's the equivalent of about 46 pounds of chocolate at the discounted rate, or over 10 pounds for free! (The average chocolate consumption in the USA is 12 pounds per year, so if you consume See's chocolate exclusively, this would be a medium term investment.)

- But wait! There's more! These are GIFT certificates. You don't have to consume all the chocolate yourself, you can give them to friends, customers, or even to me* out of gratitude for suggesting this investment! Furthermore, they never expire, so you can buy all your gifts now and they will keep on giving until you run out. And, as the price of chocolate inevitably increases, the recipients will appreciate them more each year.

- Don't forget the tax advantages! If you buy a normal security and it appreciates, you have to pay tax on the increased value. The IRS has no way of taxing a box of chocolate. (At least not yet. Perhaps in the far future they'll demand a Key Lime Truffle, or even, if you make a killing, a Butterscotch Square.)

Is there a catch? Possibly. Since See's is only a half-national chain, and the certificates only cover the price of chocolate, you will have to pay for shipping if you get them by mail order. Karen told me the certificates can cover shipping, too, at the fixed value of $14.50 each. In effect, then, they're also good for a shipping discount. Whether that value will increase with the price of chocolate is unclear. She said "No" but I have my doubts. Ten years from now, how will they remember?

You may be skeptical but I'm going for it. I've already made my judgment on a lifetime supply of socks and swimsuits. I never thought I'd have the opportunity to do it for chocolate as well!

*Postal address supplied on request

NP: "Always Never" - Porcupine Tree

| © 2007 |

| Richard Factor |