RIKLBLOG

|

| Tomorrow |

| 26 Sept. 2006 |

| Yesterday |

| Index |

| Eventide |

| SETI League |

| PriUPS Project |

| Bonus! |

| Contact |

USDUC Watch - The Hybrid Tax Rebate

I introduced the supra-departmental USDUC a few weeks ago. This office, the United States Department of Unintended Consequences, oversees not just governmental activities, but also watches over many civilian pursuits, because, as they put it, "your security and happiness is important to you!"

Amazingly, the secretary of USDUC, knowing this blog's interest in the Prius, and pleased with his accomplishments in the area of hybrid vehicle tax credits, volunteered to give me a quick interview. We discussed how USDUC has worked with both houses of Congress to make the hybrid tax credit less effective even though the legislators intended otherwise.

Q: Mr. Secretary, I understand that you had a hand in

drafting the language of the hybrid tax credit bill.

A: Yes, the Congress was determined to pass legislation to

encourage people to purchase hybrid vehicles that were good for the

environment and reduce gasoline consumption. In accordance with

our mission, we worked with the sponsors to make sure the legislation

had perverse consequences.

Q: So you didn't try to thwart the passage of the

legislation?

A: No, that's not what we do. Some might argue that the

government shouldn't be giving special tax breaks or trying to influence

consumer behavior. Others would say that the program is a good

thing. Our mission, stated simply, is to make sure that the

program, ill-advised or not, doesn't work in the way people would think

it should.

Q: How did you do that?

A: We got the legislators to put in limits. Cleverly,

these limits not only limited the scope of the program, but also assured

that people would be discouraged from buying the best of the hybrids

such as the Prius, and encouraged them to buy cars where the gas savings

were less. We did this by dividing the credits into manufacturer

groupings, so that once a manufacturer's cars ran out of credits, they

would only be available for cars of other manufacturers. That

meant that the less efficient cars would get higher credits. If we

had just limited the total number of credits instead, people would have

bought any car they pleased.

Q: That's diabolical! I'm impressed.

A: Yes, we were proud of it, too. We called it "fairness."

We'd love to trademark that one! We were hoping, again in the name

of fairness, to get legislation passed so that every vehicle got

a tax rebate in the same manner, but we're not all-powerful, of course.

Q: Were there any other aspects of the legislation that

you helped modify?

A: Yes. The whole point of the legislation was to

encourage people to save gas and pollute less. Of course that

means that it should encourage people who drive a lot—cab

drivers, salesmen and so forth—to

purchase hybrids. One congressman had the notion of giving an

insurance rebate on the theory that insurance cost is partly based on

mileage driven.

Q: Squelched that one, didn't you?

A: Yes. Not a hint of that made it into the final

legislation

Q: Thank you for your time, Mr. Secretary. May we

call on you in the future to explain other activities of your

department?

A: Certainly, although I may have to send a deputy.

We get very busy here around election time. Whenever there's a new

crop of well-meaning legislators we like to run seminars for them and of

course they expect the top man to be available.

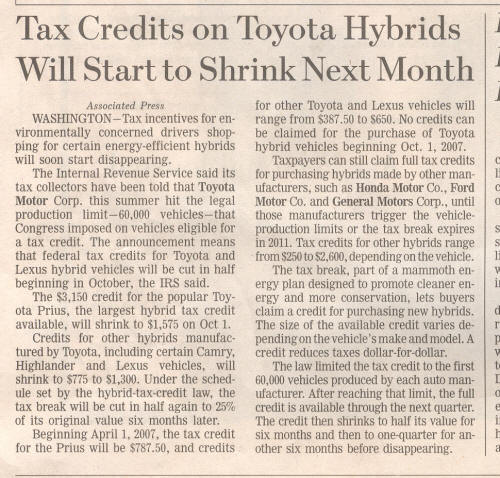

I'd like to thank the USDUC secretary for stopping by the RIKLBLOG today. We don't normally do interviews with government officials, but he's our kind of Gov. Guy. Here's the Wall Street Journal article (21 September 2006) explaining the credit issue in more detail.

Good work, Mr. Secretary!

| © 2006 |

| Richard Factor |