RIKLBLOG

|

| Tomorrow |

| 20 March 2009 |

| Yesterday |

| Index |

| Eventide |

| SETI League |

| PriUPS Project |

| Bonus! |

| Contact |

The Two Birds Theory

Neither a Texter Nor a Textee Be, part II

In my whine yesterday about Verizon's charge for texting, I was shortsighted. I have declined the texting feature on my cellphone and the monthly charge attendant thereto. I observed that Verizon's greed in charging (a lot!) for a service that costs them nothing is foolish. In reconsidering, I realized that it is even more foolish than I thought. It is so foolish, in fact, that Verizon should be offering a discount for texting!

My cell phone plan provides me far more "minutes" than I can possibly use. That's probably true for many if not all customers. Of course, if there is "plan" time remaining, any call you make is free to you. Even so, it uses wireless network resources, since each second of telephone talk is the equivalent in bandwidth of many text messages. If you can substitute a short text for a voice babble, it benefits Verizon in terms of network usage. In the aggregate, it means fewer towers must be built, fewer dollars spent on infrastructure, etc.

I get at least one solicitation a week from Verizon for "high-speed internet service" which is their epithet for "slower than cable" since they don't offer FIOS in my area yet. After today, I shall be carefully checking for the "here's a discount coupon for texting" letter.

A Word From Woot!

|

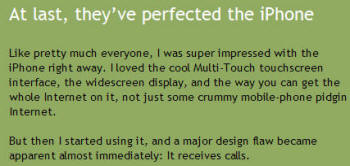

Woot! is offering (today only) an Apple 8GB 2nd Generation iPod Touch for $169.99. I'm not sure how good a deal that is, but they certainly put their very silly finger on one of the major flaws of the iPhone in their ad for the iPod! |

Economic Crisis - The Two Birds Theory

Although it seems that the current economic crisis only started with the popping of the housing bubble, I wonder if it couldn't have been stopped in its tracks before the credit default swap problem exacerbated it. The government encouraged people to buy houses with money they didn't have. "Teaser" mortgages of one sort or another offered unrealistic initial terms. Then, when the mortgages reset to higher rates, people started defaulting, resulting in the foreclosures and the plummeting of housing values we have now. Meanwhile, the speculators who bought houses the market didn't need hoping to "flip" them added to the party. In other words, too much house supply, too little demand.

If the government had stepped in to buy the houses for the current value of the mortgage instead of allowing the defaults, the value of housing would have remained more-or-less stable, there would have been no financial crisis, and the taxpayers would have faced a big bill, albeit probably smaller than the one that we have now. And, of course, the government would own a lot of houses, with a large percentage of them in the hard-hit states of California, Arizona, and Nevada, and Florida. What to do with these houses?

The other crisis we haven't quite reached yet and is being ignored for the moment is Social Security. There will be a big deficit in that program down the road. But: Don't retirees like to live in California, Arizona, Nevada, and God's waiting room—Florida? Why not offer Social Security recipients the ability to live in these houses, with their rent paid by a decrease in their SS benefits? Because there would be a wide variety of government-owned houses, from shacks to mansions, let the retirees bid on the "rental" price. This would keep it all (except for the initial house purchases) properly capitalistic.

Since the remaining taxpayers will eventually have to bail out the Social Security program, perhaps this could be (or at least could have been) a down payment, or maybe even enough to prevent that future necessity. I don't know if this would have (or will) work. It's just a random thought I've been having, and I'm always willing to "share."

|

Special Advertising Section Please buy this lovely blue Corvette ZR1! Now, with Collector's Kit |

|

NP: "Tape from California" - Phil Ochs

| © 2009 |

| Richard Factor |